How to Effectively Calculate Mortgage Loan Payments for Your Dream Home

### Understanding Mortgage LoansA mortgage loan is a type of loan specifically used to purchase real estate, where the property itself serves as collateral……

### Understanding Mortgage Loans

A mortgage loan is a type of loan specifically used to purchase real estate, where the property itself serves as collateral. When you take out a mortgage, you agree to repay the loan amount plus interest over a specified period, typically 15 to 30 years. Understanding how to calculate mortgage loan payments is crucial for potential homebuyers, as it helps them gauge their financial commitment and plan their budgets accordingly.

### The Importance of Calculating Mortgage Loan Payments

Calculating mortgage loan payments allows homebuyers to understand how much they can afford to borrow based on their income, expenses, and current financial situation. This process involves considering several factors, including the loan amount, interest rate, loan term, and any additional costs like property taxes, insurance, and private mortgage insurance (PMI). By accurately calculating these payments, buyers can avoid financial strain and ensure they are making a sound investment.

### Key Components of Mortgage Loan Calculation

To calculate mortgage loan payments, you will need to consider the following components:

1. **Principal Amount**: This is the total amount of money you are borrowing to purchase the home.

2. **Interest Rate**: The interest rate is the cost of borrowing the principal amount, expressed as a percentage. It can be fixed (remains the same throughout the loan term) or variable (can change at specified intervals).

3. **Loan Term**: This refers to the length of time you have to repay the loan, typically ranging from 15 to 30 years.

4. **Property Taxes**: These are taxes levied by the government based on the value of the property. They can be included in your monthly mortgage payment.

5. **Homeowners Insurance**: This insurance protects your home against damages and is often required by lenders.

6. **PMI**: If your down payment is less than 20% of the home's purchase price, you may be required to pay private mortgage insurance.

### How to Calculate Mortgage Loan Payments

To calculate your monthly mortgage payment, you can use the following formula:

\[ M = P \frac{r(1 + r)^n}{(1 + r)^n - 1} \]

Where:

- \( M \) = Total monthly mortgage payment

- \( P \) = Principal loan amount

- \( r \) = Monthly interest rate (annual rate / 12)

- \( n \) = Number of payments (loan term in months)

For example, if you are borrowing $300,000 at an annual interest rate of 3.5% for 30 years, your monthly payment would be:

1. Convert the annual interest rate to a monthly rate: \( 3.5\% / 100 / 12 = 0.00291667 \)

2. Determine the total number of payments: \( 30 \times 12 = 360 \)

3. Plug these values into the formula to calculate \( M \).

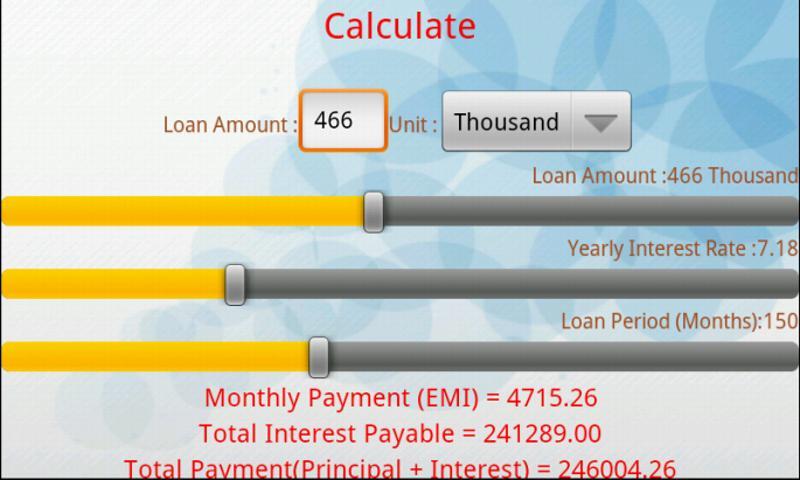

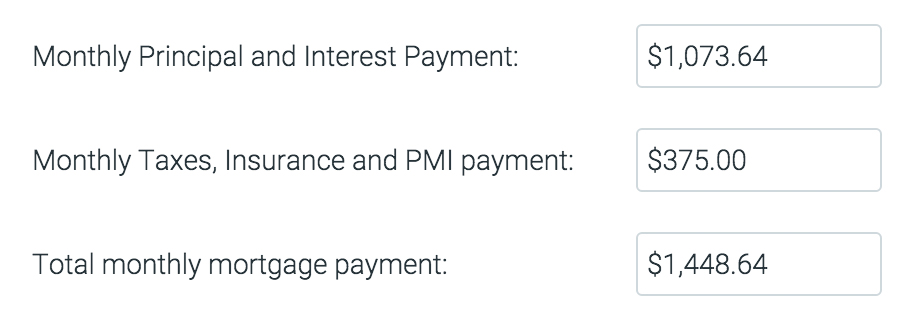

### Using Online Mortgage Calculators

While manual calculations can provide a good estimate, many homebuyers prefer using online mortgage calculators for convenience and speed. These tools allow you to input your loan amount, interest rate, and loan term to quickly calculate your monthly payments. They can also provide estimates for property taxes, insurance, and PMI, giving you a more comprehensive view of your total housing costs.

### Conclusion

Understanding how to calculate mortgage loan payments is an essential skill for anyone looking to buy a home. By taking the time to accurately assess your financial situation and use the appropriate formulas or online tools, you can make informed decisions about your home purchase. This knowledge not only helps you stay within your budget but also ensures that you are prepared for the long-term financial commitment that comes with a mortgage loan. Whether you are a first-time homebuyer or looking to refinance, mastering this calculation can lead to a more successful and satisfying home buying experience.