"How to Create an Effective Student Loan Amortization Table in Excel for Better Financial Planning"

#### Understanding Student Loan AmortizationStudent loan amortization refers to the process of paying off your student loans over time through a series of s……

#### Understanding Student Loan Amortization

Student loan amortization refers to the process of paying off your student loans over time through a series of scheduled payments. This involves breaking down the total amount owed into manageable monthly payments that cover both the principal and interest. Understanding how amortization works is crucial for students and graduates alike, as it can significantly impact their financial health in the long run.

#### Why Use an Amortization Table?

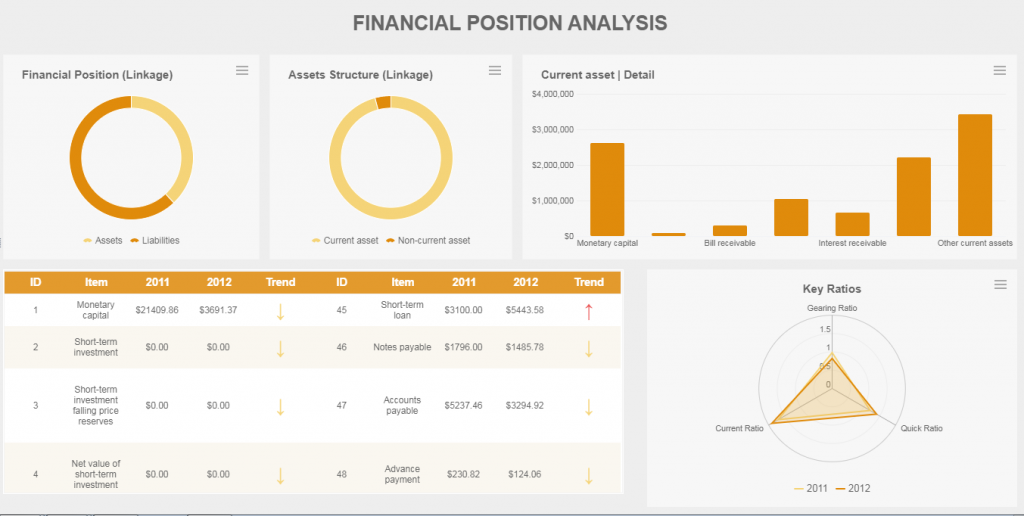

An amortization table provides a clear and organized way to track your loan payments over time. It allows borrowers to see how much of each payment goes towards the principal versus interest, helping them understand the true cost of their loans. With a well-structured table, you can also identify how long it will take to pay off your loans and how much interest you will pay over the life of the loan. This information is vital for budgeting and financial planning.

#### Creating a Student Loan Amortization Table in Excel

Creating a student loan amortization table in Excel is a straightforward process. Here’s a step-by-step guide to help you set it up:

1. **Open Excel**: Start a new spreadsheet.

2. **Set Up Your Columns**: Label the first row with the following headers:

- Payment Number

- Payment Amount

- Interest Payment

- Principal Payment

- Remaining Balance

3. **Input Your Loan Details**: In the cells below the headers, input your loan amount, interest rate, and loan term (in months).

4. **Calculate Monthly Payment**: Use the PMT function to calculate your monthly payment. The formula is:

```

=PMT(interest_rate/12, loan_term, -loan_amount)

5. **Fill in the Amortization Table**:

- For the first payment, calculate the interest payment by multiplying the remaining balance by the monthly interest rate.

- Subtract the interest payment from the total monthly payment to find the principal payment.

- Update the remaining balance by subtracting the principal payment from the previous balance.

- Repeat these calculations for each subsequent payment until the loan is paid off.

6. **Format Your Table**: Use Excel’s formatting tools to make your table easy to read. You can use borders, bold headings, and color coding to highlight important figures.

#### Benefits of Using Excel for Amortization Tables

Using Excel for your student loan amortization table has several advantages. First, it allows for easy customization. You can adjust your inputs and see how changes in interest rates or payment amounts affect your overall repayment plan. Additionally, Excel provides powerful calculation tools, making it easy to perform complex financial analyses without needing specialized software.

#### Conclusion

A student loan amortization table in Excel is an invaluable tool for anyone managing student debt. It not only helps you understand your repayment schedule but also empowers you to make informed financial decisions. By following the steps outlined above, you can create a comprehensive amortization table that will aid you in your journey to financial freedom. Whether you are just starting your loan repayment or looking for ways to pay off your loans faster, having a clear view of your payments can make all the difference.