Understanding the Impact of Student Loan Bankruptcies on Financial Health and Future Opportunities

Guide or Summary:Student Loan BankruptciesThe Rise of Student Loan DebtChallenges of Discharging Student LoansThe Impact of Student Loan Bankruptcies on Bor……

Guide or Summary:

- Student Loan Bankruptcies

- The Rise of Student Loan Debt

- Challenges of Discharging Student Loans

- The Impact of Student Loan Bankruptcies on Borrowers

- Alternatives to Bankruptcy

- Future of Student Loan Bankruptcies

Student Loan Bankruptcies

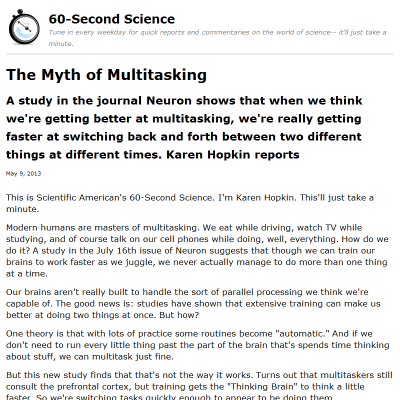

Student loan bankruptcies refer to the legal process through which individuals can discharge their student loan debts in bankruptcy court. This complex and often misunderstood topic has gained significant attention in recent years, particularly as the burden of student loan debt continues to rise in the United States. Many borrowers find themselves struggling to meet their monthly payments, leading them to explore the possibility of bankruptcy as a means to alleviate their financial distress.

The Rise of Student Loan Debt

In the past decade, student loan debt has reached staggering levels, with over $1.7 trillion owed by borrowers across the nation. This growing financial burden has prompted discussions about the implications of student loan bankruptcies. As more individuals grapple with the inability to repay their loans, the bankruptcy system becomes a potential avenue for relief. However, it's essential to understand that discharging student loans in bankruptcy is not as straightforward as it is for other types of debt.

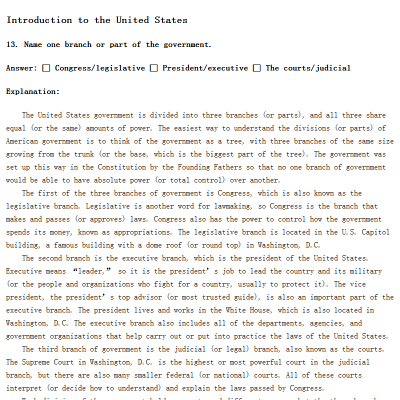

Challenges of Discharging Student Loans

Under the current U.S. bankruptcy law, student loans are generally considered non-dischargeable unless the borrower can prove "undue hardship." This standard is notoriously difficult to meet, requiring borrowers to demonstrate that repaying the loans would impose an insurmountable financial strain. Courts typically apply a three-part test known as the Brunner test, which assesses the borrower's current financial situation, future earning potential, and whether they have made good faith efforts to repay the loans.

The Impact of Student Loan Bankruptcies on Borrowers

For those who successfully navigate the bankruptcy process and discharge their student loans, the impact can be life-changing. It can provide a fresh start and allow individuals to rebuild their financial health. However, the consequences of filing for bankruptcy can also be severe. It may result in a significant drop in credit score, making it challenging to secure future loans, housing, or even employment in certain fields. Additionally, the stigma associated with bankruptcy can affect personal relationships and self-esteem.

Alternatives to Bankruptcy

Before considering bankruptcy, borrowers should explore alternative options for managing their student loan debt. Income-driven repayment plans, loan consolidation, and refinancing can provide more manageable payment options without the long-term consequences of bankruptcy. Additionally, borrowers may qualify for loan forgiveness programs, especially if they work in public service or meet specific criteria.

Future of Student Loan Bankruptcies

As the conversation around student loan debt continues to evolve, there is growing advocacy for reforming the bankruptcy laws related to student loans. Some policymakers and advocates argue that making it easier to discharge student loans in bankruptcy could provide much-needed relief for millions of borrowers. This potential shift could reshape the landscape of student loan debt and provide a more equitable solution for those in financial distress.

In conclusion, student loan bankruptcies represent a critical intersection of education, finance, and law. While they offer a potential path to relief for some borrowers, the challenges and consequences associated with this process are significant. As the student debt crisis continues to unfold, understanding the nuances of student loan bankruptcies will be essential for borrowers seeking to navigate their financial futures.