Understanding EIDL Loans Forgiven: What You Need to Know About the Forgiveness Process

#### EIDL Loans ForgivenThe Economic Injury Disaster Loan (EIDL) program was established to provide financial relief to small businesses affected by disaste……

#### EIDL Loans Forgiven

The Economic Injury Disaster Loan (EIDL) program was established to provide financial relief to small businesses affected by disasters, including the COVID-19 pandemic. One of the most appealing aspects of EIDL loans is the potential for forgiveness, which can significantly alleviate the financial burden on business owners. In this article, we will explore the details surrounding EIDL loans forgiven, including eligibility, application processes, and tips for maximizing your chances of receiving forgiveness.

#### What Are EIDL Loans?

EIDL loans are low-interest loans offered by the Small Business Administration (SBA) to help businesses cover operational costs during challenging times. These loans can be used for various expenses, including payroll, rent, utilities, and other necessary operational costs. While EIDL loans must typically be repaid, certain conditions allow for a portion of the loan to be forgiven, making them an attractive option for many business owners.

#### Eligibility for EIDL Loans Forgiveness

To qualify for EIDL loans forgiven, businesses must meet specific criteria. First, the funds from the EIDL loan must have been used for eligible expenses, such as payroll costs, rent, and utilities. Additionally, the business must demonstrate that it has been adversely affected by a declared disaster, such as the COVID-19 pandemic.

It's essential to keep accurate records of how the loan funds were used, as this documentation will be required during the forgiveness application process. Businesses should also ensure that they have not laid off employees or reduced their wages significantly, as this can impact their eligibility for forgiveness.

#### Application Process for Forgiveness

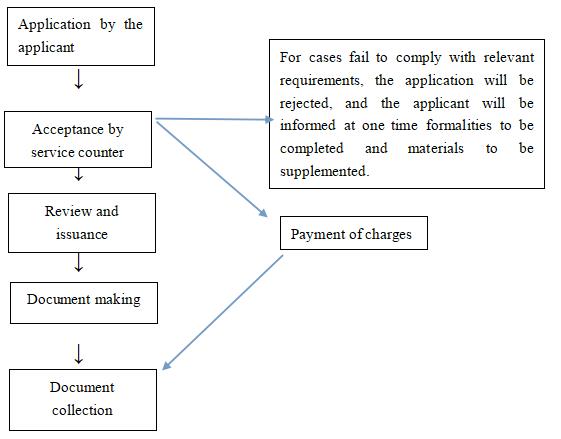

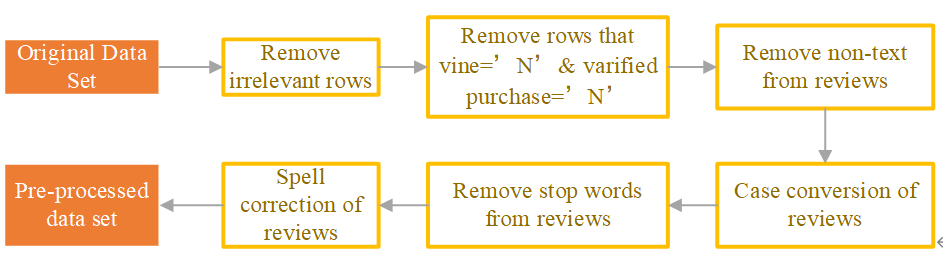

The application process for EIDL loans forgiven involves several steps. First, business owners must gather all necessary documentation, including proof of eligible expenses and any relevant payroll records. Once the documentation is in order, businesses can submit their forgiveness application to the SBA.

The SBA will review the application and supporting documents to determine whether the business meets the criteria for forgiveness. It's important to note that the forgiveness process can take time, so businesses should be prepared for a waiting period before receiving a decision.

#### Maximizing Your Chances of Forgiveness

To increase the likelihood of EIDL loans forgiven, business owners should take proactive steps throughout the loan period. Here are some tips:

1. **Keep Detailed Records**: Maintain thorough records of all expenses related to the EIDL loan. This includes invoices, receipts, and payroll documentation.

2. **Understand Eligible Expenses**: Familiarize yourself with what constitutes eligible expenses under the EIDL program. This knowledge will help ensure that you use the funds appropriately.

3. **Consult with Professionals**: If you're unsure about the forgiveness process or eligibility requirements, consider consulting with a financial advisor or accountant. They can provide guidance and help you navigate the complexities of the application process.

4. **Stay Informed**: Keep up to date with any changes in the EIDL program or forgiveness guidelines. The SBA may update its policies, and being informed will help you make the best decisions for your business.

#### Conclusion

EIDL loans forgiven can provide significant relief for small businesses struggling to recover from disasters. By understanding the eligibility requirements, application process, and best practices for maximizing forgiveness, business owners can navigate this financial support program more effectively. Remember to keep detailed records and consult with professionals if needed to ensure a smooth and successful forgiveness process.