"Ultimate Guide to Mortgage Loan Search: Tips, Tools, and Strategies for Homebuyers"

Guide or Summary:Understanding Mortgage Loan SearchWhy is a Mortgage Loan Search Important?How to Conduct a Mortgage Loan SearchCommon Mistakes to Avoid in……

Guide or Summary:

- Understanding Mortgage Loan Search

- Why is a Mortgage Loan Search Important?

- How to Conduct a Mortgage Loan Search

- Common Mistakes to Avoid in Your Mortgage Loan Search

**Translation of "mortgage loan search":** 住房贷款搜索

Understanding Mortgage Loan Search

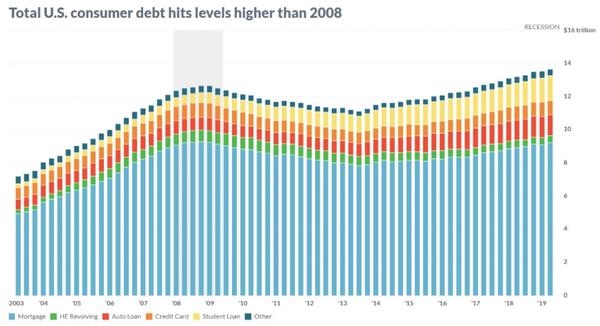

The process of mortgage loan search can seem overwhelming to many homebuyers, especially first-timers. It involves researching and comparing various mortgage options available in the market to find the best fit for your financial situation. A thorough mortgage loan search is crucial because it can significantly affect your monthly payments, overall interest costs, and the total amount you will pay over the life of the loan.

Why is a Mortgage Loan Search Important?

A comprehensive mortgage loan search is essential for several reasons. First, it helps you understand the different types of mortgages available, such as fixed-rate, adjustable-rate, and interest-only loans. Each type has its own advantages and disadvantages, and knowing these can help you make an informed decision.

Second, the rates and terms offered by lenders can vary widely. A diligent mortgage loan search allows you to compare these rates and terms, potentially saving you thousands of dollars over the life of your loan. Additionally, understanding the fees associated with different loans, such as origination fees, closing costs, and private mortgage insurance, is vital to getting the best deal.

How to Conduct a Mortgage Loan Search

1. **Determine Your Budget:** Before you start your mortgage loan search, assess your financial situation. Calculate how much you can afford for a down payment and monthly mortgage payments. This will help narrow down your options.

2. **Research Lenders:** Look for various lenders, including banks, credit unions, and online mortgage companies. Each lender may have different products and rates, so it’s important to compare them thoroughly.

3. **Use Online Tools:** Many websites offer mortgage calculators and comparison tools to assist in your mortgage loan search. These tools can provide estimates on monthly payments based on different loan amounts and interest rates.

4. **Check Your Credit Score:** Your credit score plays a significant role in the rates you’ll be offered. Before starting your mortgage loan search, check your credit report and address any issues that might negatively impact your score.

5. **Get Pre-Approved:** Once you’ve narrowed down your options, consider getting pre-approved for a mortgage. This process involves a lender reviewing your financial information and giving you a conditional commitment for a loan amount, which can strengthen your position when making an offer on a home.

Common Mistakes to Avoid in Your Mortgage Loan Search

1. **Not Shopping Around:** One of the biggest mistakes homebuyers make is failing to compare multiple lenders. A thorough mortgage loan search can uncover better rates and terms.

2. **Ignoring Fees:** Many borrowers focus solely on interest rates and overlook the importance of fees. Always consider the annual percentage rate (APR), which includes both the interest rate and any associated fees.

3. **Focusing on Monthly Payments Only:** While it’s important to know what you can afford monthly, also consider the total cost of the loan over its lifetime. A lower monthly payment might come with a higher overall cost.

4. **Neglecting to Read the Fine Print:** Always read the terms and conditions of any mortgage agreement thoroughly. Understanding the details can prevent unpleasant surprises later on.

In conclusion, conducting a thorough mortgage loan search is a critical step in the home-buying process. By understanding the different types of loans, comparing multiple lenders, and being aware of fees and terms, you can make an informed decision that aligns with your financial goals. Take your time, do your research, and don’t hesitate to seek professional advice if needed. A well-informed borrower is more likely to secure a favorable mortgage that meets their needs.