"Maximize Your Savings: How to Use the ARM Mortgage Loan Calculator Effectively"

Guide or Summary:ARM Mortgage Loan Calculator is a specialized tool designed to help potential homebuyers and homeowners evaluate the costs associated with……

Guide or Summary:

#### What is an ARM Mortgage Loan Calculator?

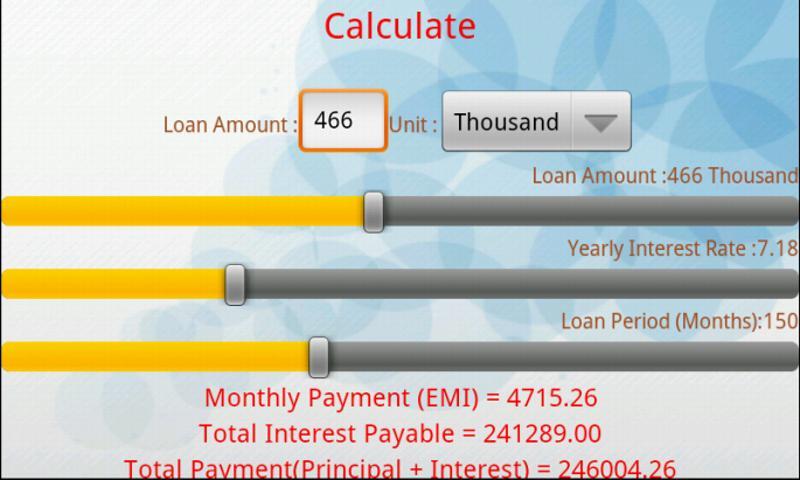

ARM Mortgage Loan Calculator is a specialized tool designed to help potential homebuyers and homeowners evaluate the costs associated with Adjustable Rate Mortgages (ARMs). This calculator provides a detailed breakdown of monthly payments, interest rates, and potential savings over time, enabling users to make informed financial decisions.

### Understanding Adjustable Rate Mortgages

An Adjustable Rate Mortgage (ARM) is a type of home loan where the interest rate is not fixed but can change at specified intervals. Typically, ARMs start with a lower initial interest rate compared to fixed-rate mortgages, making them attractive to many borrowers. However, as the loan progresses, the interest rate can fluctuate based on market conditions.

### Benefits of Using an ARM Mortgage Loan Calculator

Using an ARM Mortgage Loan Calculator offers several advantages:

1. **Cost Estimation**: It provides an accurate estimate of monthly payments, helping you understand how much you can afford.

2. **Interest Rate Projections**: The calculator can project future interest rates based on historical data, giving you insight into potential changes.

3. **Loan Comparison**: You can compare different ARM options, allowing you to choose the best one for your financial situation.

4. **Long-term Planning**: It helps in planning for the long term by showing how changes in interest rates can affect your overall loan cost.

### How to Use the ARM Mortgage Loan Calculator

To effectively use an ARM Mortgage Loan Calculator, follow these steps:

1. **Input Loan Details**: Start by entering the loan amount, initial interest rate, and the length of the loan term.

2. **Adjust Rate Changes**: Input the frequency of rate adjustments (e.g., annually, bi-annually) and the index rate that will be used to determine future rates.

3. **Review Results**: Analyze the output, which typically includes monthly payments, total interest paid over the life of the loan, and a breakdown of how payments change over time.

4. **Make Adjustments**: Experiment with different scenarios by changing the loan amount, interest rates, or adjustment intervals to see how it affects your payments.

### Key Factors to Consider

When using an ARM Mortgage Loan Calculator, keep in mind the following factors:

- **Initial Rate Period**: Understand how long the initial lower rate lasts before adjustments begin.

- **Rate Caps**: Familiarize yourself with the caps on how much the interest rate can increase at each adjustment and over the life of the loan.

- **Market Trends**: Stay informed about current market trends and economic conditions that may affect interest rates.

### Conclusion

In summary, the ARM Mortgage Loan Calculator is an invaluable tool for anyone considering an Adjustable Rate Mortgage. By providing clear and comprehensive estimates of loan costs and potential savings, it empowers borrowers to make well-informed decisions. Whether you are a first-time homebuyer or looking to refinance, utilizing this calculator can help you navigate the complexities of ARMs and ultimately lead to significant financial benefits. Make sure to take advantage of this resource to maximize your savings and achieve your homeownership goals.