Optimize Your Finances with the Student Loans Save Plan Calculator: A Comprehensive Guide

#### Understanding the Student Loans Save Plan CalculatorThe **Student Loans Save Plan Calculator** is an essential tool designed to help borrowers navigate……

#### Understanding the Student Loans Save Plan Calculator

The **Student Loans Save Plan Calculator** is an essential tool designed to help borrowers navigate the complexities of student loan repayment. With rising education costs and varying interest rates, managing student debt can be overwhelming. This calculator provides a clear and concise way to estimate monthly payments, total interest paid, and the impact of different repayment strategies.

#### Why Use the Student Loans Save Plan Calculator?

Using the **Student Loans Save Plan Calculator** allows borrowers to make informed decisions about their loan repayment options. It takes into account various factors such as income, loan amounts, interest rates, and repayment terms. By inputting these details, users can visualize how different repayment plans will affect their financial future.

For instance, the calculator can show the difference between standard repayment plans and income-driven repayment options. This is particularly beneficial for graduates entering the workforce with varying salary expectations. Understanding these options can lead to significant savings over time.

#### How to Use the Student Loans Save Plan Calculator

Using the **Student Loans Save Plan Calculator** is straightforward. First, gather all necessary information about your student loans, including total loan amounts, interest rates, and any existing repayment plans. Next, input these details into the calculator.

Once the information is entered, the calculator will generate an estimate of your monthly payments and the total amount paid over the life of the loan. You can also experiment with different scenarios, such as increasing monthly payments or adjusting the repayment term, to see how these changes affect your overall financial picture.

#### Benefits of Planning Ahead

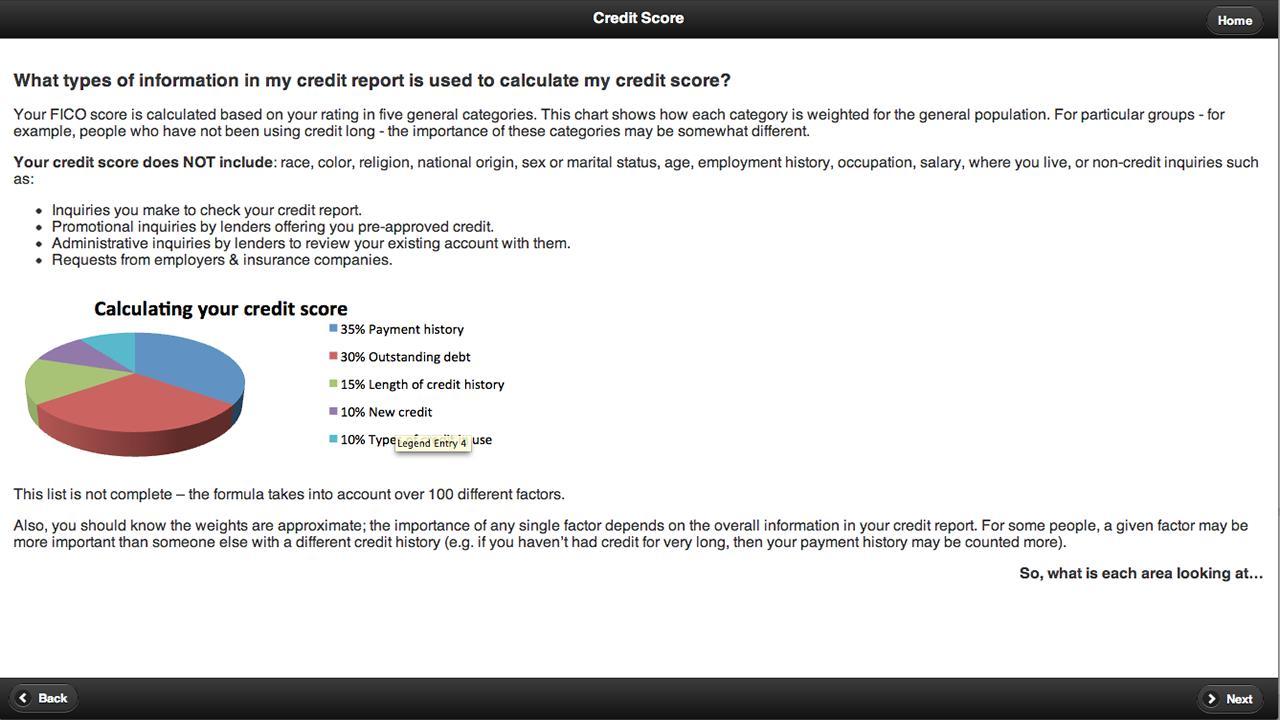

One of the primary advantages of using the **Student Loans Save Plan Calculator** is the ability to plan ahead. By understanding your repayment obligations early on, you can budget accordingly. This proactive approach can help you avoid falling behind on payments, which can lead to additional fees and a negative impact on your credit score.

Moreover, the calculator can help identify potential savings through loan consolidation or refinancing. By comparing different repayment strategies, you can choose the one that aligns best with your financial goals and lifestyle.

#### Conclusion: Take Control of Your Student Loans

Navigating student loans can be a daunting task, but with tools like the **Student Loans Save Plan Calculator**, you can take control of your financial future. By understanding your repayment options and planning accordingly, you can reduce the stress associated with student debt.

In summary, the **Student Loans Save Plan Calculator** is more than just a number-crunching tool; it's a vital resource for anyone looking to manage their student loans effectively. Whether you are a recent graduate or someone looking to refinance existing loans, this calculator can provide the insights needed to make sound financial decisions. Start using the calculator today and take the first step towards financial freedom.