Loan Amortization Schedule Calculator: Unlocking the Secrets to Your Financial Future

Guide or Summary:Loan Amortization Schedule Calculator: Your Guide to Financial ClarityMastering Loan Amortization with the Loan Amortization Schedule Calcu……

Guide or Summary:

- Loan Amortization Schedule Calculator: Your Guide to Financial Clarity

- Mastering Loan Amortization with the Loan Amortization Schedule Calculator

- Why Choose the Loan Amortization Schedule Calculator?

In the ever-evolving financial landscape, making informed decisions about loans is crucial. Whether you're taking out a mortgage, student loan, or personal loan, understanding the intricacies of loan amortization can significantly impact your financial health. This is where the Loan Amortization Schedule Calculator steps in, offering a comprehensive tool to decode the complexities of loan repayment and optimize your financial strategy.

Loan Amortization Schedule Calculator: Your Guide to Financial Clarity

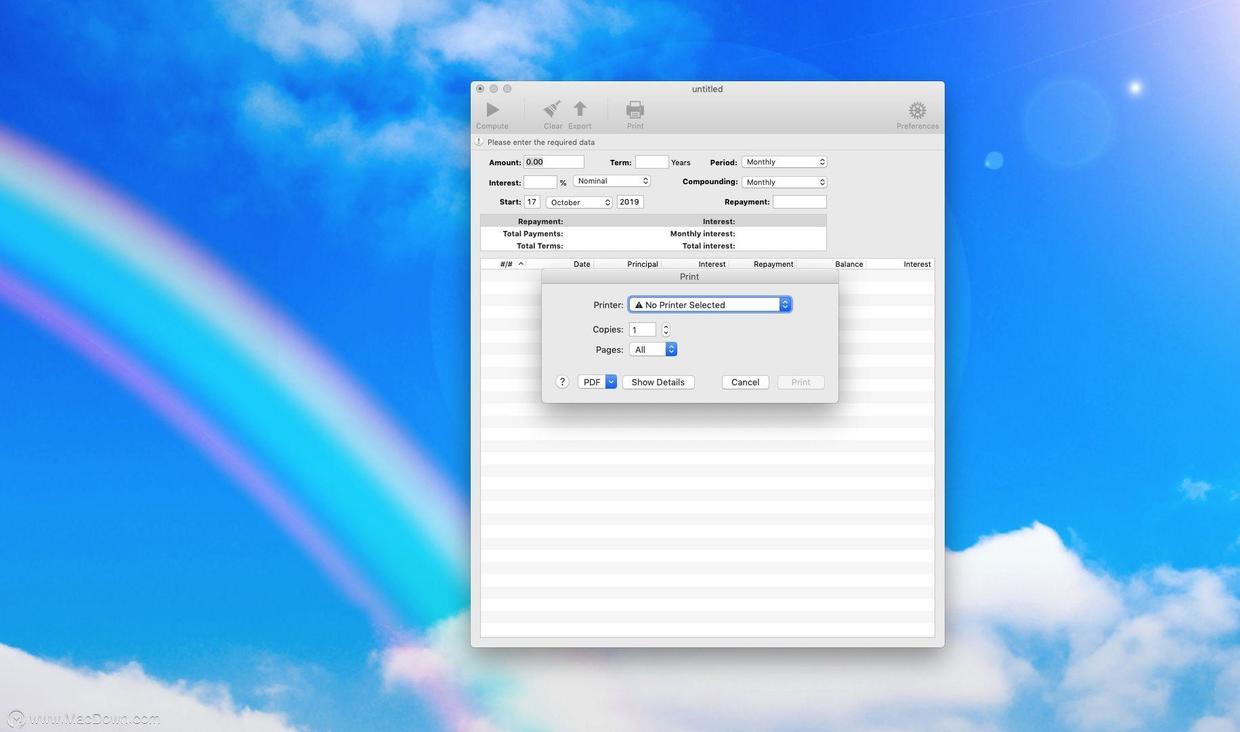

Navigating the maze of loan repayment can be daunting. With its meticulously designed interface, the Loan Amortization Schedule Calculator simplifies the process, turning it into a straightforward exercise. This calculator not only provides a detailed amortization schedule but also offers insights into the impact of various repayment scenarios, helping you make informed decisions that align with your financial goals.

Mastering Loan Amortization with the Loan Amortization Schedule Calculator

Understanding loan amortization is akin to unlocking a treasure chest of financial wisdom. The Loan Amortization Schedule Calculator is your key, providing a clear, concise, and easy-to-understand breakdown of how your loan works. With its user-friendly design, this calculator empowers you to:

- **Customize Your Loan Terms**: Tailor your loan repayment plan to fit your unique financial situation, ensuring that your payments are neither too burdensome nor too lenient.

- **Explore Repayment Scenarios**: Delve into different repayment strategies to uncover the most cost-effective way to pay off your loan, saving you time and money in the long run.

- **Track Your Progress**: Monitor your loan repayment journey, witnessing the gradual reduction of your debt and the growth of your financial freedom.

- **Plan for the Future**: Use the insights gained from the calculator to make informed decisions about your financial future, whether it's saving for a down payment on a home, planning for retirement, or simply building a rainy-day fund.

Why Choose the Loan Amortization Schedule Calculator?

In a world where financial literacy is key, the Loan Amortization Schedule Calculator stands out as a beacon of clarity. It offers:

- **Accuracy and Reliability**: Built on robust financial models, this calculator provides precise amortization schedules, ensuring that you're making informed decisions based on accurate data.

- **Customization**: Tailor your loan terms to your specific needs, ensuring that your repayment plan is both effective and efficient.

- **Ease of Use**: Navigate through the calculator with ease, thanks to its intuitive interface and straightforward navigation.

- **Insightful Analysis**: Uncover the hidden truths about your loan, including the impact of interest rates, loan terms, and repayment strategies on your financial health.

In conclusion, the Loan Amortization Schedule Calculator is more than just a tool; it's a gateway to financial empowerment. By demystifying the complexities of loan amortization, this calculator empowers you to make informed decisions that shape your financial future. Whether you're embarking on a new financial journey or looking to optimize an existing loan, the Loan Amortization Schedule Calculator is your ally in achieving financial clarity and success.