Bankrate Calculators: Unraveling the Mortgage Loan Calculator for Clearer Financial Decisions

In the ever-evolving world of finance, making informed decisions about mortgages and loans is paramount to ensuring long-term financial stability. Amidst th……

In the ever-evolving world of finance, making informed decisions about mortgages and loans is paramount to ensuring long-term financial stability. Amidst the plethora of financial tools and resources available, Bankrate Calculators stand out as a beacon of clarity and precision. Among these, the Mortgage Loan Calculator is a particularly powerful tool that empowers users with the knowledge to make wise financial choices.

The Mortgage Loan Calculator, available through Bankrate, is an indispensable resource for anyone navigating the complexities of home ownership and financing. It provides a comprehensive, user-friendly platform that simplifies the process of calculating mortgage payments, understanding the impact of various factors on your monthly expenses, and projecting the long-term financial implications of your loan choices.

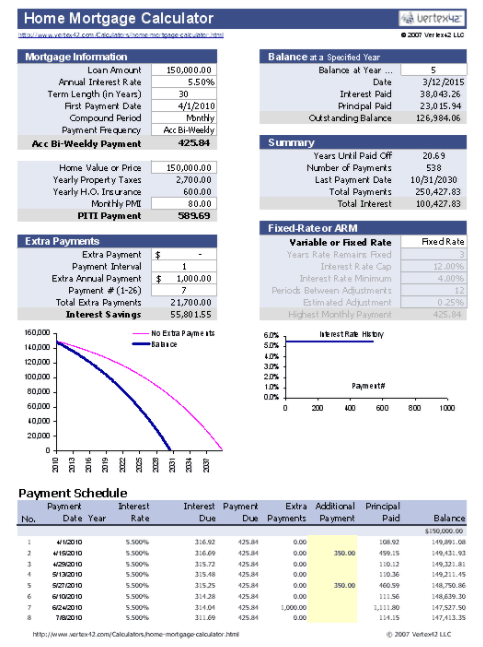

To begin with, the Mortgage Loan Calculator from Bankrate offers a straightforward approach to determining your monthly mortgage payments. By inputting essential details such as the loan amount, interest rate, and loan term, users can receive precise calculations that reflect the true cost of their mortgage. This feature is invaluable for potential homebuyers, enabling them to make informed comparisons between different loan options and identify the most affordable and feasible choice for their financial situation.

Beyond basic payment calculations, the Mortgage Loan Calculator delves into the intricacies of amortization, providing users with a detailed breakdown of how their loan balance is reduced over time. This information is crucial for understanding the long-term financial implications of your mortgage, allowing you to plan effectively for future refinancing or repayment strategies.

One of the standout features of the Mortgage Loan Calculator is its ability to simulate different scenarios, helping users visualize the impact of various factors on their mortgage payments. For instance, users can explore the effects of changing interest rates, loan terms, or down payment amounts on their monthly expenses and overall loan costs. This flexibility empowers users to make informed decisions that align with their financial goals and risk tolerance.

Moreover, the Mortgage Loan Calculator from Bankrate offers valuable insights into the concept of "points," which are fees paid to reduce interest rates and lower monthly payments. By providing a clear explanation of how points work and their potential impact on loan costs, users can make more informed choices when deciding whether to pay points for a lower interest rate.

In addition to its practical functionalities, the Mortgage Loan Calculator stands out for its commitment to transparency and user education. Bankrate's tool provides comprehensive explanations and definitions for key terms and concepts, ensuring that users are not only equipped with the necessary calculations but also a solid understanding of the underlying principles governing mortgages and loans.

In conclusion, the Mortgage Loan Calculator from Bankrate is a indispensable tool for anyone seeking clarity and control in their mortgage and loan decisions. By offering precise calculations, detailed insights, and a user-friendly interface, it empowers users to make informed choices that align with their financial goals and long-term objectives. Whether you are a seasoned homeowner or a first-time buyer, the Mortgage Loan Calculator is a valuable resource that can help you navigate the complexities of mortgage financing with confidence and precision.