Understanding the 60000 Home Loan Payment: Your Comprehensive Guide to Managing Your Mortgage

Guide or Summary:60000 home loan payment60000 home loan payment---### Description:When embarking on the journey of home ownership, understanding the intrica……

Guide or Summary:

60000 home loan payment

---

### Description:

When embarking on the journey of home ownership, understanding the intricacies of a mortgage is crucial. One common figure that many potential homeowners encounter is the 60000 home loan payment. This amount can vary based on numerous factors, including interest rates, loan terms, and down payments. In this comprehensive guide, we will explore the details surrounding a 60000 home loan payment, helping you navigate your financial responsibilities and make informed decisions.

#### What is a 60000 Home Loan Payment?

A 60000 home loan payment refers to the monthly amount you would need to pay if you took out a mortgage of $60,000. The actual payment will depend on several variables, including the interest rate, loan term, and whether you have private mortgage insurance (PMI) or other fees. Understanding how these factors play into your monthly payment is essential for budgeting and financial planning.

#### Factors Influencing Your Home Loan Payment

1. **Interest Rates**: The interest rate on your mortgage significantly impacts your monthly payment. A lower interest rate means lower payments, while a higher rate can make your mortgage more expensive. Interest rates can fluctuate based on the economy and your credit score, so it’s vital to shop around and find the best rate.

2. **Loan Term**: The length of your mortgage also plays a crucial role in determining your monthly payment. Common loan terms are 15, 20, or 30 years. A shorter term typically results in higher monthly payments but less interest paid over the life of the loan. Conversely, a longer term spreads the payments out, resulting in lower monthly payments but more interest paid overall.

3. **Down Payment**: The amount you put down when purchasing your home can affect your loan amount and monthly payment. A larger down payment reduces the amount you need to borrow, which can lower your monthly payment. Additionally, putting down 20% or more can help you avoid PMI, further reducing your costs.

4. **Property Taxes and Homeowners Insurance**: Your monthly payment may also include property taxes and homeowners insurance. These costs can vary significantly based on your location and the value of your home. It’s essential to factor these expenses into your budget when considering a 60000 home loan payment.

5. **Private Mortgage Insurance (PMI)**: If your down payment is less than 20%, you may be required to pay PMI, which protects the lender in case you default on the loan. This additional cost can increase your monthly payment, so it’s crucial to understand how it affects your overall mortgage payment.

#### Calculating Your Monthly Payment

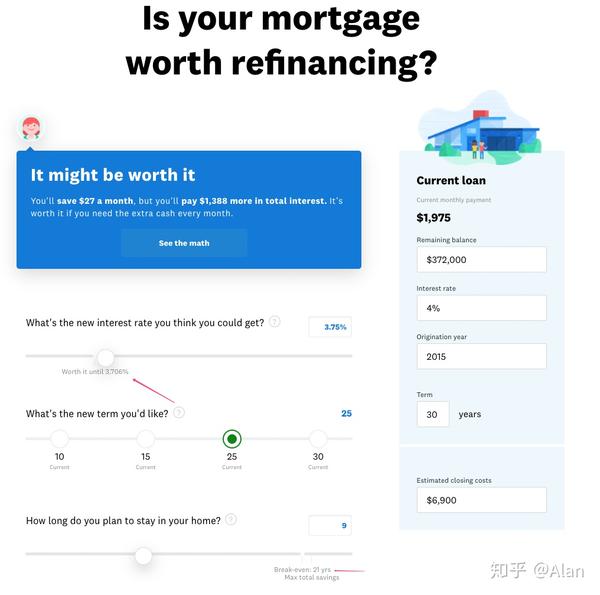

To get an accurate estimate of your 60000 home loan payment, you can use online mortgage calculators. These tools allow you to input your loan amount, interest rate, loan term, and other variables to see what your monthly payment will be. This can be an invaluable resource when budgeting for your new home.

#### Tips for Managing Your Home Loan Payment

1. **Create a Budget**: Understanding your monthly payment is just the beginning. Creating a budget that includes your mortgage payment, utilities, maintenance, and other living expenses will help you manage your finances effectively.

2. **Consider Refinancing**: If interest rates drop or your credit score improves, consider refinancing your mortgage. This can lower your monthly payment and save you money over the life of the loan.

3. **Make Extra Payments**: If possible, making extra payments toward your principal can reduce the total interest you pay and help you pay off your mortgage faster.

4. **Stay Informed**: Keep an eye on market trends and changes in interest rates. Staying informed can help you make strategic financial decisions regarding your home loan.

In conclusion, understanding the 60000 home loan payment is essential for anyone looking to purchase a home. By considering the various factors that influence your mortgage payment and effectively managing your finances, you can navigate the complexities of home ownership with confidence. Whether you're a first-time buyer or looking to refinance, being informed is the key to making sound financial decisions.