Unlocking Financial Opportunities: Exploring Loan Banks for Bad Credit Solutions

Guide or Summary:Loan banks for bad credit specialize in providing financial solutions tailored to individuals with less-than-perfect credit histories. Thes……

Guide or Summary:

---

### Description:

In today's financial landscape, many individuals find themselves grappling with the challenges of poor credit scores. Whether due to unforeseen medical expenses, job loss, or other financial hardships, bad credit can significantly limit your borrowing options. However, the emergence of loan banks for bad credit offers a glimmer of hope for those seeking financial assistance. This article explores the various avenues available to individuals with bad credit, shedding light on how loan banks for bad credit can help restore financial stability.

#### Understanding Bad Credit

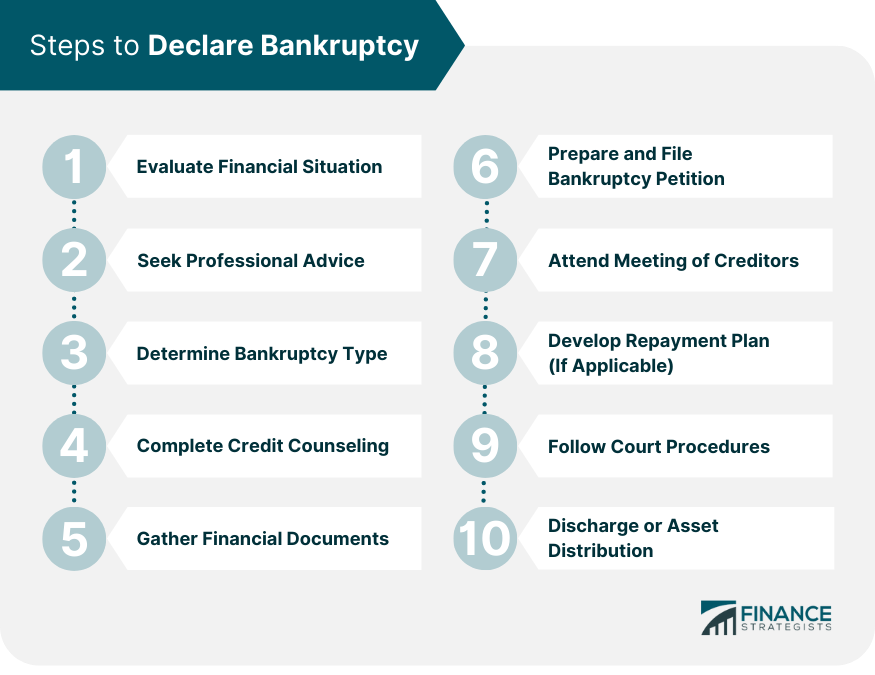

Bad credit is typically defined as a credit score below 580 on the FICO scale. This score can result from a variety of factors, including late payments, high credit utilization, and bankruptcies. Individuals with bad credit often face higher interest rates and limited borrowing options, making it challenging to secure loans for essential expenses such as medical bills, home repairs, or even debt consolidation.

#### The Role of Loan Banks for Bad Credit

Loan banks for bad credit specialize in providing financial solutions tailored to individuals with less-than-perfect credit histories. These institutions understand that a poor credit score does not necessarily reflect a person's current financial situation or their ability to repay a loan. By offering personalized loan options, loan banks for bad credit help bridge the gap for those in need of immediate financial assistance.

#### Types of Loans Available

1. **Personal Loans**: Many loan banks for bad credit offer personal loans that can be used for various purposes, including debt consolidation, home improvements, or unexpected expenses. These loans often come with flexible repayment terms and competitive interest rates.

2. **Secured Loans**: For individuals willing to provide collateral, secured loans can be an excellent option. By offering an asset such as a car or savings account, borrowers can access lower interest rates and larger loan amounts, making it easier to manage repayments.

3. **Payday Loans**: Although generally not recommended due to their high-interest rates, payday loans are a short-term solution for those in urgent need of cash. Many loan banks for bad credit offer payday loans, but borrowers should exercise caution and ensure they can repay the loan on time to avoid falling into a cycle of debt.

4. **Credit Builder Loans**: Some loan banks for bad credit provide credit builder loans designed specifically to help individuals improve their credit scores. These loans involve borrowing a small amount of money, which is held in a savings account until the loan is repaid. By making timely payments, borrowers can gradually rebuild their credit.

#### Benefits of Using Loan Banks for Bad Credit

- **Accessibility**: Unlike traditional banks that may reject applications based on credit scores, loan banks for bad credit often have more lenient eligibility criteria. This accessibility allows individuals with bad credit to secure necessary funds.

- **Improved Approval Rates**: Many loan banks for bad credit focus on the overall financial situation of the borrower rather than solely relying on credit scores. This holistic approach increases the chances of loan approval.

- **Financial Education**: Some loan banks for bad credit provide resources and guidance to help borrowers understand their financial options better. This education can empower individuals to make informed decisions about their finances.

#### Tips for Securing a Loan from Loan Banks for Bad Credit

1. **Research Your Options**: Take the time to compare various loan banks for bad credit to find the best rates and terms. Look for institutions that have a solid reputation and positive customer reviews.

2. **Check Your Credit Report**: Before applying for a loan, review your credit report for any errors or discrepancies. Addressing these issues can improve your chances of loan approval and help you secure better terms.

3. **Consider a Co-Signer**: If possible, ask a family member or friend with good credit to co-sign your loan. This can increase your chances of approval and potentially lower your interest rate.

4. **Be Realistic About Loan Amounts**: When applying for a loan, be realistic about the amount you need. Borrowing only what you can afford to repay will help you avoid further financial strain.

#### Conclusion

Navigating the world of finance with bad credit can be daunting, but loan banks for bad credit provide essential support for those in need. By understanding the types of loans available and the benefits of working with specialized lenders, individuals can take proactive steps toward regaining financial stability. With careful planning and informed decision-making, securing a loan from loan banks for bad credit can be a crucial step toward a brighter financial future.