Loans

Guide or Summary:Why Choose Columbus Title Loans?Fast Approval and Cash in HandFlexible Loan Amounts and TermsKeep Your Vehicle While You PayTransparent Fee……

Guide or Summary:

- Why Choose Columbus Title Loans?

- Fast Approval and Cash in Hand

- Flexible Loan Amounts and Terms

- Keep Your Vehicle While You Pay

- Transparent Fees and No Hidden Costs

- How to Apply for Columbus Title Loans

- Conclusion: Your Path to Financial Relief

Are you facing unexpected expenses or urgent financial needs? Look no further than Columbus title loans! These loans offer a quick and convenient solution for those in need of immediate cash, allowing you to leverage the value of your vehicle for fast funding. Whether it’s an emergency medical bill, home repairs, or any other financial obligation, Columbus title loans can provide the relief you need without the hassle of traditional lending processes.

Why Choose Columbus Title Loans?

Columbus title loans are designed to be straightforward and accessible. Unlike conventional loans that often require extensive credit checks and lengthy approval processes, title loans allow you to use your vehicle’s title as collateral. This means that even if you have less-than-perfect credit, you can still qualify for a loan. The process is simple: you provide your vehicle title, and in return, you receive a loan amount based on your vehicle's value.

Fast Approval and Cash in Hand

One of the most significant advantages of Columbus title loans is the speed of approval. In many cases, you can get approved within minutes and receive cash on the same day. This quick turnaround is crucial for those facing urgent financial situations. The application process is typically done online or in-person, requiring minimal documentation. You’ll need your vehicle title, a valid ID, and proof of income, making it easy for anyone to apply.

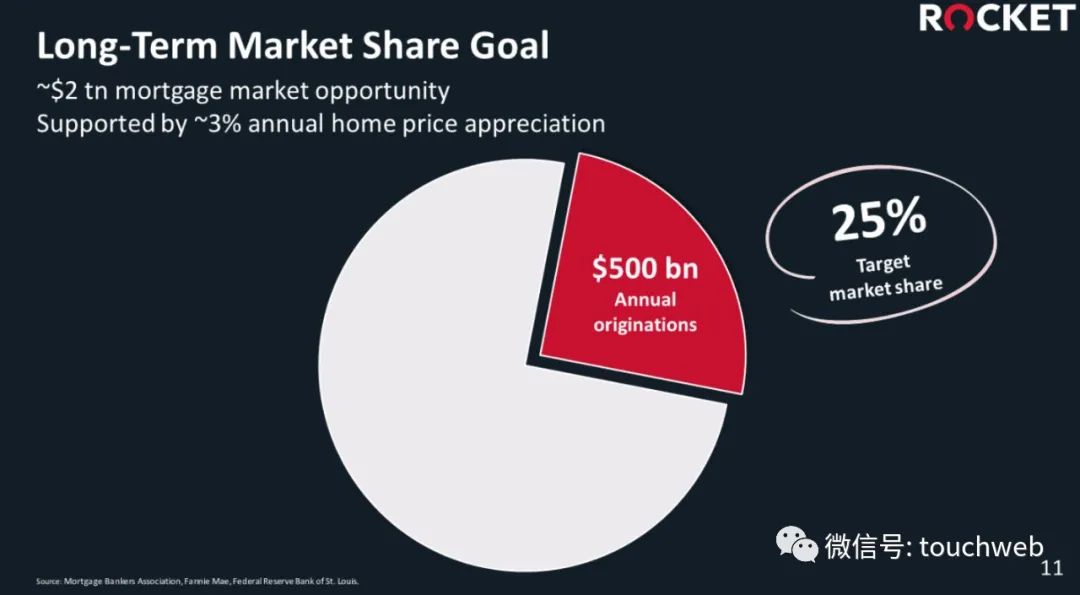

Flexible Loan Amounts and Terms

Columbus title loans offer flexibility in both loan amounts and repayment terms. Depending on the value of your vehicle, you can secure a loan ranging from a few hundred to several thousand dollars. Additionally, lenders often provide various repayment options, allowing you to choose a plan that fits your financial situation. This flexibility makes it easier for borrowers to manage their finances while still addressing their immediate cash needs.

Keep Your Vehicle While You Pay

One of the most appealing aspects of Columbus title loans is that you can continue driving your vehicle while you repay the loan. Unlike some other types of loans, where the lender may require you to hand over the vehicle, title loans allow you to keep your car. This means you can maintain your daily routine and transportation needs without interruption, all while benefiting from the cash you receive.

Transparent Fees and No Hidden Costs

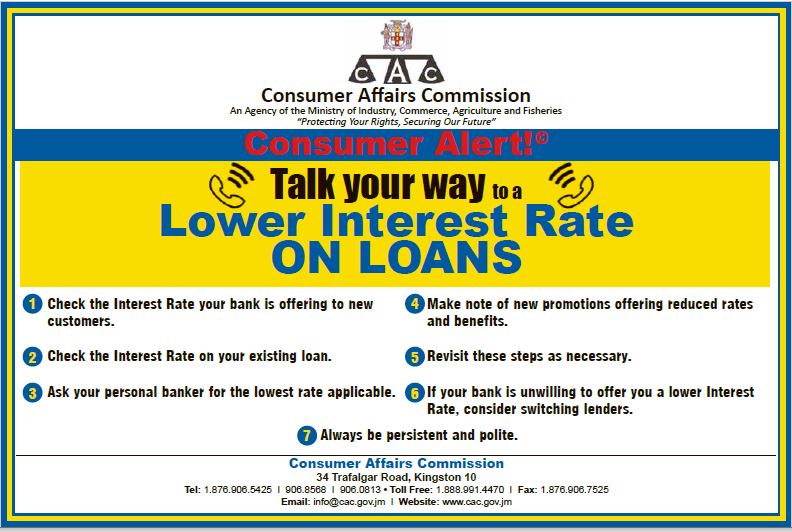

When considering a loan, it’s essential to understand the costs involved. Columbus title loans are known for their transparency. Reputable lenders will provide clear information about interest rates, fees, and repayment terms upfront, ensuring you know exactly what to expect. This transparency helps you make informed decisions and avoid any unpleasant surprises down the line.

How to Apply for Columbus Title Loans

Applying for Columbus title loans is a straightforward process. Start by researching local lenders and comparing their rates and terms. Once you’ve found a lender that meets your needs, you can fill out an application online or visit their office. Make sure to have your vehicle title, ID, and proof of income ready. After your application is submitted, the lender will evaluate your vehicle and determine the loan amount you qualify for.

Conclusion: Your Path to Financial Relief

In conclusion, Columbus title loans offer a reliable and efficient way to access quick cash when you need it most. With fast approval times, flexible loan amounts, and the ability to keep your vehicle, these loans can be a lifesaver in times of financial distress. Don't let unexpected expenses hold you back—consider Columbus title loans as your path to financial relief today!