Maximize Your Financial Planning with the Huntington Bank Loan Calculator

#### Understanding the Huntington Bank Loan CalculatorThe **Huntington Bank Loan Calculator** is an essential tool for anyone looking to take out a loan, wh……

#### Understanding the Huntington Bank Loan Calculator

The **Huntington Bank Loan Calculator** is an essential tool for anyone looking to take out a loan, whether for a home, a car, or personal expenses. This calculator provides potential borrowers with a clear and concise way to estimate their monthly payments, total interest paid, and the overall cost of the loan. By inputting various parameters such as loan amount, interest rate, and loan term, users can quickly determine what fits best within their budget.

#### Why Use the Huntington Bank Loan Calculator?

Using the **Huntington Bank Loan Calculator** offers several advantages. Firstly, it empowers borrowers to make informed decisions. By understanding how different loan amounts and interest rates affect monthly payments, users can better assess their financial situation. Secondly, it saves time and effort. Instead of manually calculating payments or relying on complicated formulas, the calculator provides instant results, allowing users to focus on other important aspects of their financial planning.

#### How to Use the Huntington Bank Loan Calculator

Using the **Huntington Bank Loan Calculator** is straightforward. Here’s a step-by-step guide:

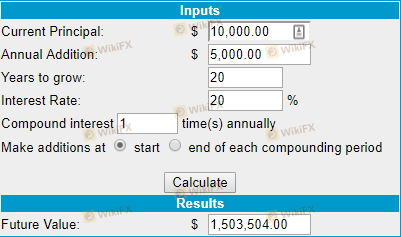

1. **Input Loan Amount**: Enter the total amount of money you wish to borrow. This could be anything from a small personal loan to a large mortgage.

2. **Select Interest Rate**: Input the interest rate offered by Huntington Bank or your estimated rate. This is crucial as it significantly influences your monthly payment and the total interest paid over the life of the loan.

3. **Choose Loan Term**: Select the duration of the loan. Common terms include 15, 20, or 30 years for mortgages, while personal loans may range from a few months to several years.

4. **Calculate**: Once all the information is entered, click the calculate button. The calculator will display your estimated monthly payment, total interest, and overall cost of the loan.

#### Benefits of Knowing Your Loan Details

Understanding the details provided by the **Huntington Bank Loan Calculator** can lead to better financial decisions. For instance, knowing your monthly payment helps you budget effectively. It also allows you to compare different loan options, making it easier to choose the best one for your needs. Moreover, being aware of the total interest paid can motivate borrowers to pay off their loans faster, potentially saving thousands in interest.

#### Conclusion: Empower Your Financial Future

In conclusion, the **Huntington Bank Loan Calculator** is a vital resource for anyone considering taking out a loan. It simplifies the loan process, provides clarity on financial commitments, and empowers users to make informed decisions. Whether you are a first-time borrower or looking to refinance, utilizing this calculator can help you navigate the complexities of loans with confidence. By understanding your options and knowing what to expect, you can take significant steps toward achieving your financial goals.