Understanding Closing Costs for USDA Home Loans: A Comprehensive Guide

#### Closing Cost USDA Home LoanWhen considering a USDA home loan, it's essential to understand the associated costs, particularly the closing costs. Closin……

#### Closing Cost USDA Home Loan

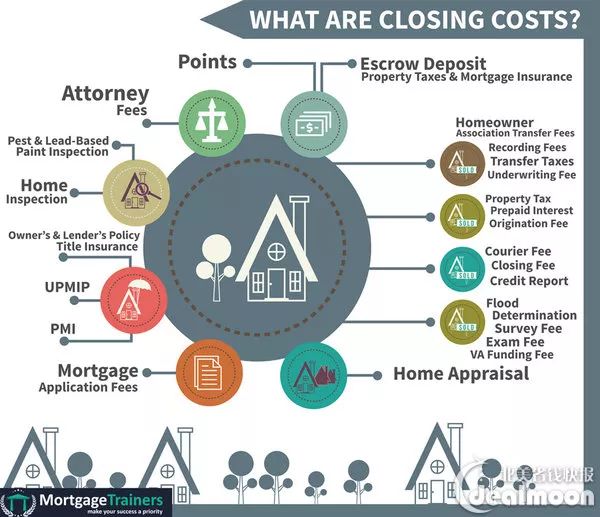

When considering a USDA home loan, it's essential to understand the associated costs, particularly the closing costs. Closing costs are the fees and expenses you incur when finalizing your mortgage. These can include various charges such as loan origination fees, appraisal fees, title insurance, and more. For those looking to purchase a home in rural areas with the assistance of a USDA loan, knowing what to expect in terms of closing costs can help you plan your budget effectively.

#### What are Closing Costs?

Closing costs typically range from 2% to 5% of the loan amount, and they can vary based on the lender, the location of the property, and the specific terms of the loan. For USDA home loans, these costs can often be rolled into the loan amount, which can be beneficial for borrowers who may not have significant cash reserves available at closing.

#### Breakdown of Closing Costs for USDA Home Loans

1. **Loan Origination Fees**: This fee is charged by the lender for processing the loan application. It can vary widely but is usually around 1% of the loan amount.

2. **Appraisal Fees**: An appraisal is required to determine the home's market value. The cost for this service can range from $300 to $500, depending on the property's location and size.

3. **Title Insurance**: This protects against any potential issues with the title of the property. Title insurance costs can vary but typically range from $1,000 to $2,000.

4. **Credit Report Fees**: Lenders will pull your credit report to assess your creditworthiness, which usually costs around $30 to $50.

5. **Prepaid Taxes and Insurance**: Lenders often require you to prepay some property taxes and homeowners insurance at closing. This can add a significant amount to your closing costs.

6. **Recording Fees**: These are fees charged by the local government to record the new mortgage and deed. They can vary based on the county but are typically a few hundred dollars.

#### How to Reduce Closing Costs

While closing costs can seem daunting, there are several ways to potentially reduce them:

- **Shop Around**: Different lenders may offer different rates and fees. It's wise to compare offers from multiple lenders to find the best deal.

- **Negotiate**: Some closing costs are negotiable. Don't hesitate to ask your lender if they can lower certain fees.

- **USDA Loan Benefits**: One of the significant advantages of USDA loans is that they allow for certain closing costs to be financed into the loan. This means you may not need to have all the cash upfront.

- **Seller Contributions**: In some cases, the seller may be willing to cover a portion of your closing costs as part of the negotiation process.

#### Conclusion

Understanding the closing costs associated with a USDA home loan is crucial for any prospective homebuyer. By being informed about what these costs entail and exploring ways to minimize them, you can ensure a smoother home-buying experience. Always consult with your lender and real estate agent to get a clear picture of what to expect and how to best navigate your financial obligations during the closing process. With careful planning and research, you can make the most of your USDA home loan and achieve your dream of homeownership in rural America.