Discover the Best Home Loan Calculator South Africa for Your Dream Home Financing

Guide or Summary:Understanding Home Loan Calculator South AfricaWhy Use a Home Loan Calculator?Key Features of Home Loan CalculatorsHow to Use a Home Loan C……

Guide or Summary:

- Understanding Home Loan Calculator South Africa

- Why Use a Home Loan Calculator?

- Key Features of Home Loan Calculators

- How to Use a Home Loan Calculator South Africa

- Benefits of Using Home Loan Calculators

Understanding Home Loan Calculator South Africa

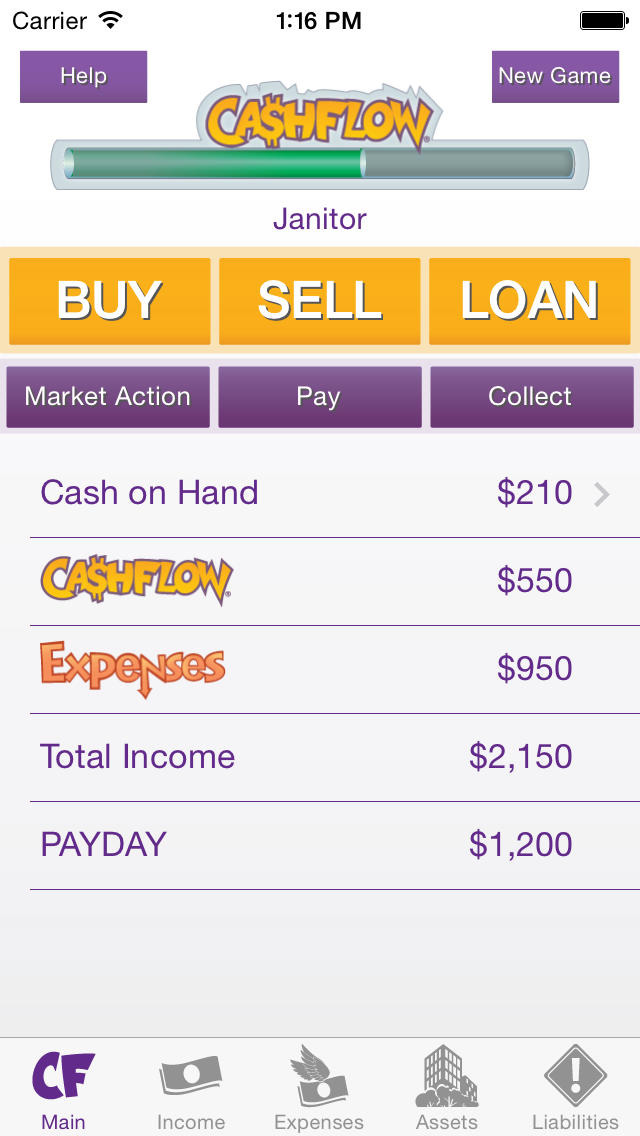

A home loan calculator South Africa is an essential tool for anyone looking to buy a property in this beautiful country. This online calculator allows potential homebuyers to estimate their monthly mortgage repayments based on various factors, including the loan amount, interest rate, and loan term. By using this tool, you can gain a clearer understanding of what you can afford and how different variables affect your overall financial commitment.

Why Use a Home Loan Calculator?

Using a home loan calculator South Africa provides numerous benefits. Firstly, it saves you time by quickly generating estimates that would otherwise require complex calculations. Secondly, it empowers you to make informed decisions about your home loan options. By adjusting the loan amount or interest rate, you can see how these changes impact your monthly payments and total interest paid over the life of the loan. This insight is invaluable when comparing different mortgage offers from various lenders.

Key Features of Home Loan Calculators

Most home loan calculators in South Africa come equipped with several key features. They typically allow you to input the following:

- **Loan Amount**: The total amount you wish to borrow.

- **Interest Rate**: The annual interest rate offered by your lender.

- **Loan Term**: The duration over which you plan to repay the loan, usually expressed in years.

- **Additional Costs**: Some calculators also allow you to factor in additional costs such as insurance, property taxes, and maintenance fees.

By incorporating these variables, the calculator provides a comprehensive view of your potential financial obligations.

How to Use a Home Loan Calculator South Africa

Using a home loan calculator South Africa is straightforward. Here’s a step-by-step guide:

1. **Input Loan Amount**: Start by entering the amount you wish to borrow. This is usually based on the property price minus your deposit.

2. **Enter Interest Rate**: Input the interest rate you expect to receive. You can find this through your lender or by researching current market rates.

3. **Select Loan Term**: Choose the duration for which you plan to take the loan. Common terms are 20 or 30 years.

4. **Calculate**: Click the calculate button to see your estimated monthly payments and total interest paid over the loan term.

5. **Adjust Variables**: Experiment with different loan amounts, interest rates, and terms to see how they affect your monthly repayments.

Benefits of Using Home Loan Calculators

One of the primary benefits of using a home loan calculator South Africa is that it helps you budget effectively. By knowing your monthly repayment amount, you can plan your finances better and ensure that you are not overextending yourself. Additionally, it can assist you in determining how much you can afford to borrow, which is crucial in the home-buying process.

Furthermore, using this tool can help you compare different mortgage products and lenders. By inputting various interest rates from different banks, you can quickly see which option is the most cost-effective.

In conclusion, a home loan calculator South Africa is an indispensable resource for prospective homebuyers. It simplifies the complex calculations involved in mortgage repayments, enabling you to make more informed financial decisions. Whether you are a first-time buyer or looking to refinance your existing mortgage, utilizing a home loan calculator can help you navigate the process with confidence. Start your journey towards homeownership today by leveraging this powerful tool!